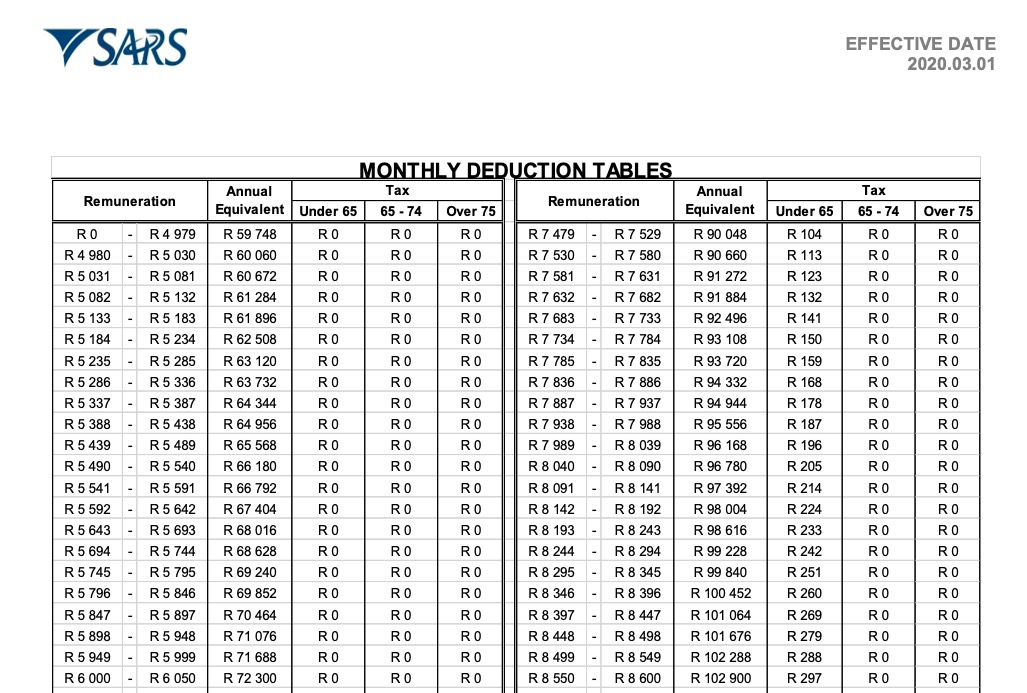

For the 2025/24 tax year, the tax brackets are as follows: The south african revenue service (sars) has updated its information for taxpayers for the 2025 tsx season, which begins next week.

Tax rates are proposed by the minister of finance in the annual budget speech and fixed or passed by parliament each year.

South Africa Weekly Tax Calculator 2025 Weekly Salary After Tax, 2025 tax year (1 march 2025 to 28 february 2025). 26% on income above r237,100, plus a fixed amount

Tax rates for the 2025 year of assessment Just One Lap, For the 2025/24 tax year, the tax brackets are as follows: Calculate you monthly salary after tax using the online south africa tax calculator, updated with the 2025 income tax rates in south africa.

Monthly Tax Brackets 2025 South Africa Lilli Paulina, 2025 / 2025 tax year: The tax rates for the 2025 tax year, starting on 1st march 2025 and ending on 28th february 2025 are:

R5604.902k Salary After Tax in South Africa ZA Tax 2025, The table below shows the personal income tax rates for 2025/25, as well as the rebates and thresholds. Calculate your personal income tax for 2025/2025.

R60k Salary After Tax in South Africa ZA Tax 2025, Rates of tax for individuals. The overall maximum effective tax rates for individuals remain unchanged from last year at 18% and for companies and trusts it is 21,6% (previously 22,4%) and 36% respectively.

Tax Bracket 2025 South Africa Grier Celinda, The personal income tax phase of filing season 2025 commences. Rates of tax for individuals.

R45k Salary After Tax in South Africa ZA Tax 2025, 2025 tax rates, thresholds and allowance for individuals, companies, trusts and small business corporations (sbc) in south africa. Stay ahead of the curve with tax updates from pkf.

R8324.902k Salary After Tax in South Africa ZA Tax 2025, 2025, 2025, 2025, 2025, 2025, 2019, 2018, 2017, 2016, 2015, etc. Use our online income tax calculator designed for individuals to help you work out your estimated monthly take.

Tax rates for the 2025 year of assessment Just One Lap, Rates of tax for individuals. Years of assessment ending any date between 1 april 2025 and 31 march 2025.

R4591k Salary After Tax in South Africa ZA Tax 2025, Standard bank expects the reserve bank to cut interest rates twice before the end of 2025 due to the. We have now calculated our effective tax rate and marginal tax rate on our annual taxable income of r 45,000.00 in south africa for the 2025 tax year and can compare.

Standard bank expects the reserve bank to cut interest rates twice before the end of 2025 due to the.

The south african revenue service (sars) has updated its information for taxpayers for the 2025 tsx season, which begins next week.